The goal of the Tectonic Systematic strategy is to generate returns that are in excess, over time, of a balanced global stock and bond portfolio with similar risk, while mitigating the impact of idiosyncratic events. The portfolio is created around the following set of proven investment principals, which are blended into an efficient framework in which the portfolio can be executed:

- Volatility Targeting

- Asset Allocation – following an endowment style

- Risk Weighting to Economic Regimes – following a similar trek as risk parity without the leverage

- Low-Cost Investing and Index Deconstruction – following Bogle efficiency with DFA principals

- Efficient Rebalancing – automatic thresholds to minimize trading costs

- Sentiment and Stop Loss Triggers – designed to reduce allocations in the early stages of unpredictable and unforeseen market shocks

The Process

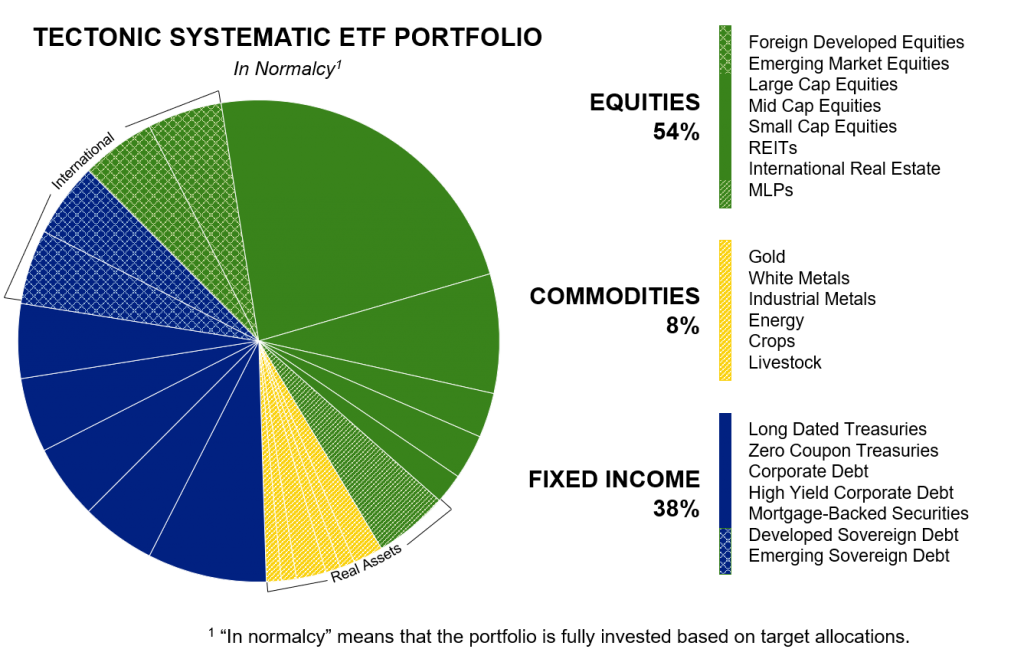

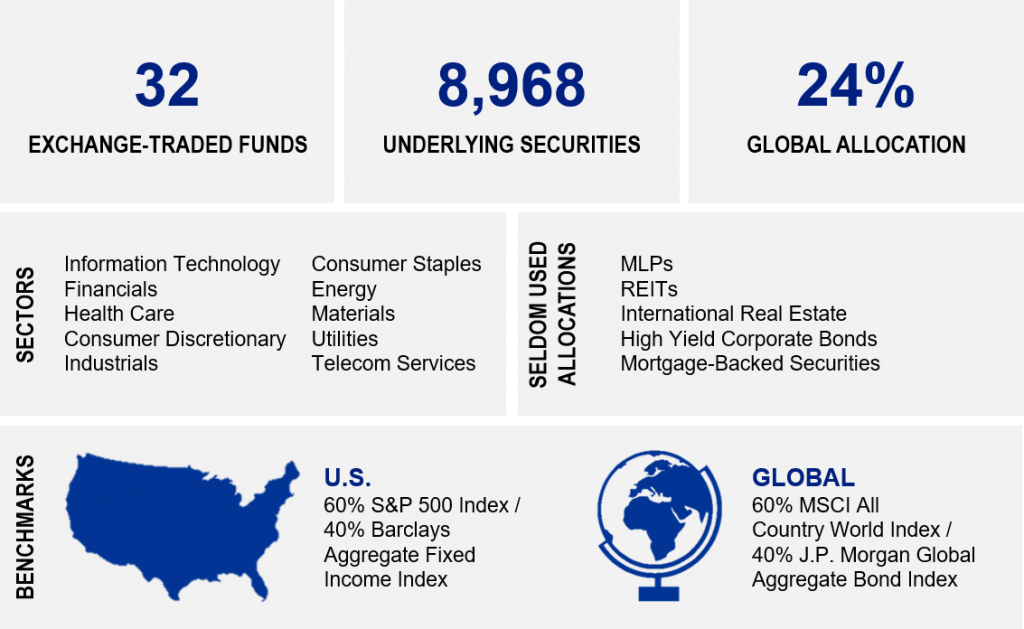

The portfolio is quantitatively managed and consists of over 30 ETFs when fully invested, and is constructed using a highly diversified allocation with positions not commonly used in traditional 60/40 strategies (i.e. MLPs, commodities, etc.). The allocation also uses a deconstructed index for domestic large cap in order to achieve long-term risk adjusted returns in excess of the cap-weighted index. The portfolio utilizes dynamic rebalancing in order to systematically reposition the portfolio based on relative valuations. This works in both overvalued and undervalued markets. The portfolio also utilizes “stop loss” triggers that are based on sentiment and momentum in order to mitigate large market drawdowns and/or unexpected idiosyncratic market events.

The portfolio is designed to keep an investor, fully invested, in the market and to exit when there are clear signs that a particular sector, asset class or the market as a whole is breaking down. For example, if the model were to indicate that the energy ETF (symbol XLE) were to exit the portfolio, but the overall broader market was healthy, the XLE position would be sold and then put into a broader equity market ETF. Likewise, for a bond position, if the treasury market were to break down, the TLT ETF would be sold and placed into a broader market bond ETF. This is a “cascading effect”, which keeps investors from moving to cash too early. If the broader stock or bond markets were to break down, that would be the environment in which the portfolio would begin to move into large cash positions.

The portfolio has the ability, under an extreme environment, to be 100% invested in cash.

The Conclusion

The Tectonic Systematic portfolio combines behavioral finance with proven investment principals to create a vehicle that attempts to do the heavy lifting for investors without the emotional stress of moving in and out of the market. By systematically implementing this portfolio over a full market cycle, the goal is to enjoy benchmark-like returns during good market periods, and outperform during poor market periods. Over a full market cycle, this is intended to result in an above benchmark return with less volatility and risk than the normal indexed global 60/40 portfolio.